Navigating the intricacies of financial management can be daunting, especially when facing unforeseen circumstances or limitations. A power of attorney document, specifically a Bank of America power of attorney PDF, acts as a powerful tool, empowering individuals to designate trusted representatives to manage their financial affairs. Whether you’re preparing for an extended travel, facing a medical emergency, or simply seeking peace of mind, understanding the ins and outs of Bank of America’s power of attorney process is essential.

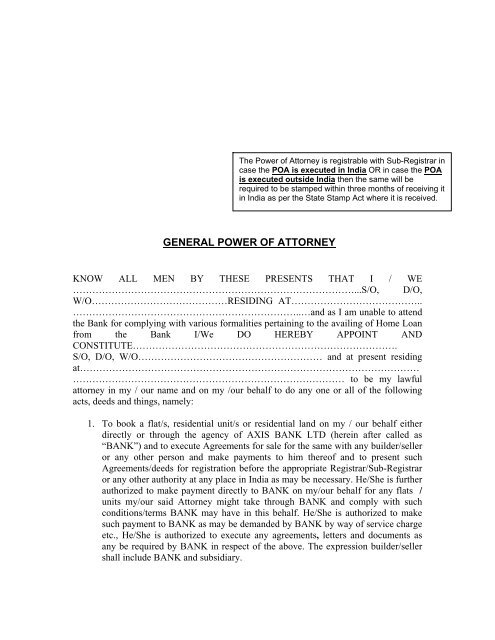

Image: www.yumpu.com

This comprehensive guide delves into the intricacies of Bank of America power of attorney PDFs, providing valuable insights to help you understand the process, navigate its complexities, and ultimately secure your financial well-being.

The Essence of Power of Attorney

What is a Power of Attorney?

A power of attorney (POA) is a legal document that grants another individual, known as the agent or attorney-in-fact, the authority to act on your behalf in specific financial or legal matters. In essence, you are temporarily delegating your decision-making power to another person. A power of attorney can be broad, encompassing all financial transactions, or narrow, focusing on specific tasks like accessing your bank account or managing investments.

Why is a Power of Attorney Important?

A power of attorney offers numerous benefits, particularly in situations where you are unable to manage your financial affairs personally. These include:

- Peace of Mind: Knowing that your financial affairs are in safe hands during your absence or incapacity provides peace of mind. You can rest assured that your bills will be paid, your investments will be managed, and your financial affairs will be handled according to your wishes.

- Contingency Planning: In case of a medical emergency or incapacitation, a POA ensures that your financial needs are met without delays or complications. Your agent can access your accounts, pay bills, and make necessary financial decisions on your behalf.

- Legal Authority: A power of attorney provides formal legal authorization, granting your agent the right to act on your behalf. This protects both you and your agent from potential legal challenges or disputes.

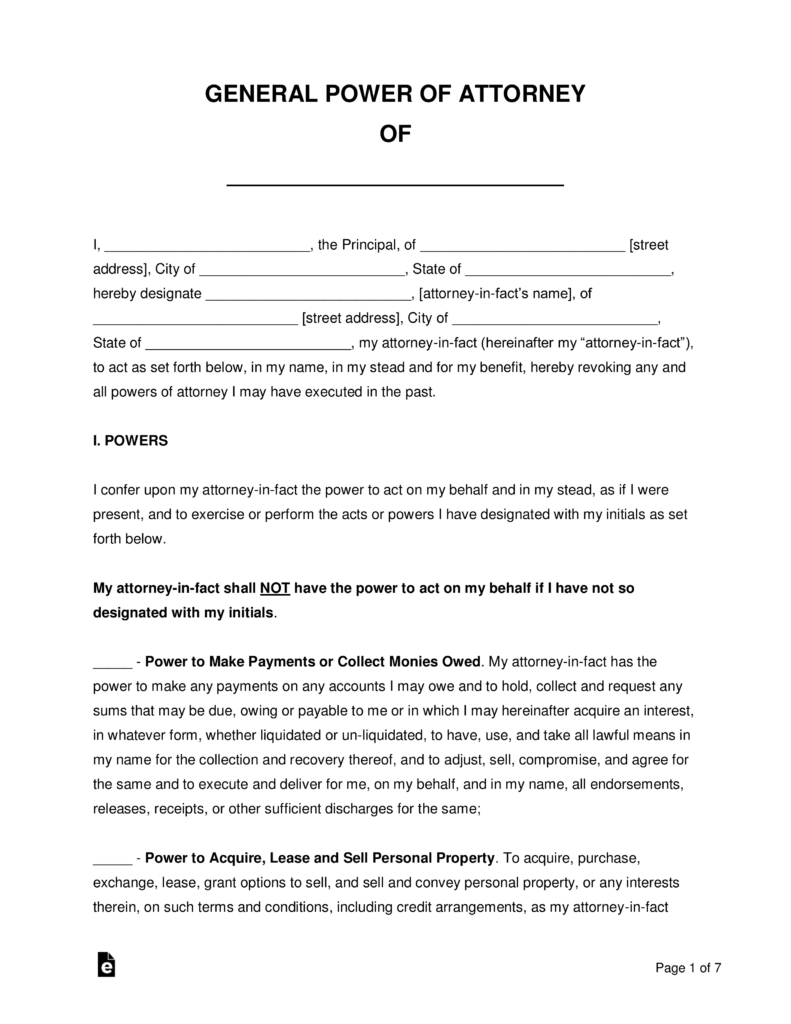

Image: worksheetlistvim.z21.web.core.windows.net

Exploring Bank of America Power of Attorney PDFs

Bank of America’s Power of Attorney Options

Bank of America offers two primary power of attorney options:

- Durable Power of Attorney: This type of POA remains active even if you become incapacitated. This is crucial for situations where you may lose the ability to make financial decisions independently.

- Springing Power of Attorney: This POA comes into effect only after you become incapacitated and is typically triggered by a medical diagnosis or event. Its activation requires evidence of incapacitation.

Key Components of a Bank of America Power of Attorney PDF

A Bank of America power of attorney PDF typically includes the following sections:

- Principals: The individual granting the power of attorney (you) and their contact information.

- Agent: The individual who will be acting on your behalf and their contact information.

- Scope of Authority: A clear definition of the specific financial transactions the agent is authorized to undertake on your behalf. This may include managing checking and savings accounts, making investments, paying bills, receiving dividends, etc.

- Duration: The effective period of the POA, which may be a specific duration or until you revoke it.

- Notarization: A designated notary public will witness your signature and ensure the document’s authenticity.

- Signatures: Both the principal and the agent must sign the document to confirm their agreement.

Obtaining and Utilizing Bank of America Power of Attorney PDFs

Where to Obtain a Bank of America Power of Attorney PDF

You can obtain a Bank of America power of attorney PDF through various methods:

- Bank of America Website: You can download a PDF template from the Bank of America website. This is a convenient option for those familiar with legal documents and comfortable completing the form themselves.

- Bank Branch: You can request a power of attorney PDF from a Bank of America branch. Branch staff can assist you with completing the form and ensure its accuracy.

- Attorney: Seeking legal counsel from an attorney is highly recommended, particularly for complex situations. They can help you tailor the document to your specific needs and ensure its compliance with state laws.

Steps for Completing a Bank of America Power of Attorney PDF

Completing the Bank of America power of attorney PDF requires careful consideration and accuracy. Follow these steps to ensure it is correctly filled out:

- Choose a Trusted Agent: Select an individual who is reliable, trustworthy, and capable of handling your financial affairs.

- Review the Template: Carefully read through the entire document, paying attention to the terms and conditions.

- Provide Accurate Information: Ensure all personal details are correct, particularly your bank account information.

- Specify the Scope of Authority: Clearly define the financial transactions the agent is authorized to handle.

- Sign and Notarize: Sign the document in front of a notary public.

- Provide the Agent with a Copy: Give a copy of the completed and notarized power of attorney document to your agent.

Considerations when Choosing an Agent

Selecting a suitable agent for your power of attorney is crucial. Consider the following factors:

- Trustworthiness: Choose someone you completely trust and who aligns with your financial values.

- Financial Acumen: It’s beneficial to select an agent with a sound understanding of financial matters, particularly if your finances are complex.

- Accessibility: Ensure the agent will be available and willing to act on your behalf when needed.

- Communication: Open communication is vital to ensure your agent understands your financial needs and goals.

The Importance of Clarity and Specificity

Clarity and specificity are key when drafting a power of attorney. The more detailed and comprehensive the document, the less room for ambiguity and potential disputes.

- Specific Transactions: Specify the exact transactions you authorize your agent to perform, such as withdrawing funds, transferring assets, or making investments.

- Limits and Restrictions: If you have any specific limits or restrictions on your agent’s authority, clearly state them in the document.

- Legal Advice: Consulting with an attorney is strongly recommended to ensure the power of attorney is properly drafted and legally sound.

Revoking or Modifying a Power of Attorney

You have the right to revoke or modify your power of attorney at any time. To do so, you must provide written notification to your agent and to Bank of America.

Revoking a Power of Attorney

To revoke a power of attorney, you must create a written revocation statement, sign it, and have it notarized. This statement should clearly indicate the date of the original power of attorney, the name of the agent, and your intention to revoke the power granted.

Modifying a Power of Attorney

To modify a power of attorney, you can create a new power of attorney document that amends the original. This new document should clearly state the specific changes you wish to make.

Common FAQs about Bank of America Power of Attorney PDFs

What if I lose the power of attorney document?

If you lose the power of attorney document, you should immediately contact Bank of America to report the loss and request a replacement.

Can I use a generic power of attorney form for Bank of America?

It’s recommended to use a power of attorney form specifically designed for Bank of America, as it ensures compliance with the bank’s requirements.

How long is a power of attorney valid for?

The validity of a power of attorney depends on its specific terms, which may be a set duration or until revoked. It’s crucial to check the document for details.

Can I use a power of attorney for a deceased person?

A power of attorney is not valid for a deceased person. Once someone has passed away, their authority and legal rights cease to exist. It is important to note that the power of attorney will expire upon the death of the principal.

Bank Of America Power Of Attorney Pdf

Conclusion: Empowering Financial Security

A Bank of America power of attorney PDF is a valuable safeguard for your financial security and can provide peace of mind in a variety of situations. By understanding the process, selecting the right agent, and drafting a clear and comprehensive document, you can effectively empower a trusted individual to manage your financial affairs ensuring continuity and protection for yourself and your loved ones.

Remember to consult with a legal professional to ensure your power of attorney document aligns with your individual needs, current state law, and Bank of America’s specific requirements. Proactive planning safeguards your financial future and offers peace of mind knowing that your financial matters are in capable hands.