Imagine applying for a loan, only to be rejected because your credit report is riddled with unnecessary inquiries. Frustrating, right? This is a common scenario, highlighting the importance of maintaining a clean credit report. It’s essential to know that every time a lender checks your credit, it leaves a hard inquiry that can temporarily lower your credit score. But did you know you can fight back? A well-crafted dispute credit inquiry removal letter can be your weapon in this battle for a clean credit report.

Image: templates.udlvirtual.edu.pe

This article will equip you with the knowledge and tools to understand credit inquiries, dispute them, and, most importantly, craft a winning dispute credit inquiry removal letter. We’ll break down the process step-by-step, from understanding the types of inquiries to crafting a compelling letter that demands results.

Understanding Credit Inquiries

Hard vs. Soft Inquiries

Credit inquiries are basically checks on your credit history. But not all inquiries are created equal. There are two main types:

- Hard Inquiries: These occur when a lender checks your credit score when you apply for a loan, credit card, or other financial product. They have a temporary negative impact on your credit score as they signal you are actively seeking credit.

- Soft Inquiries: These happen when you check your own credit report, or when a company performs a background check on you, for example, for employment purposes. They don’t affect your credit score.

While soft inquiries are harmless, it’s the hard inquiries that often cause headaches. If you see a mysterious hard inquiry on your credit report that you didn’t authorize, it’s time to take action. That’s where a dispute credit inquiry removal letter comes in.

The Power of a Dispute Credit Inquiry Removal Letter

A dispute credit inquiry removal letter is a formal request to the credit bureau to investigate and potentially remove inaccurate or unauthorized inquiries from your credit report. This letter is your official documentation detailing the discrepancy and asserting your right to a clear credit history.

The effectiveness of this letter hinges on its content and structure. It needs to be clear, concise, and persuasive. It should provide concrete evidence of the inaccuracy or unauthorized nature of the inquiry, along with your request for removal. When properly crafted, this letter can be a powerful tool in rectifying errors on your credit report.

Image: www.pdffiller.com

Crafting Your Dispute Credit Inquiry Removal Letter

Now, let’s dive into building your dispute credit inquiry removal letter. Follow these steps to create a compelling argument for removing those unwanted inquiries. It’s important to start with a professional and respectful tone throughout the letter.

Step 1: Gather Your Evidence

Before writing, gather all the supporting documents and information you can to strengthen your case. This could include:

- Copies of your credit report: This showcases the disputed inquiry.

- Proof of non-application: If you never applied for the credit product, gather evidence such as emails, phone records, or statements confirming your non-participation.

- Identity theft documentation: If you suspect identity theft, collect reports from law enforcement or identity theft prevention services.

Step 2: Identify the Credit Bureau

Your credit report likely has one of the three major credit bureaus: Experian, TransUnion, and Equifax. Your letter should be addressed to the specific bureau where the inquiry appears. You can find their contact information online.

Step 3: Write Your Letter

The letter should include the following elements:

- Your contact information: Include your name, address, phone number, and email.

- The credit bureau’s contact information: Include their name and full address.

- Date of the letter: Clearly state the date you are writing.

- Subject line: Make it clear and concise, for example: “Dispute Credit Inquiry – Your Account Number”.

- Opening paragraph: Start by politely introducing yourself and stating the purpose of the letter – to dispute an inaccurate or unauthorized credit inquiry.

- Detail the disputed inquiry: Provide the credit bureau with details, including the date of the inquiry, the lender or company involved, and the specific account or credit product in question.

- Explain why the inquiry is disputed: State explicitly that you did not apply for the credit product associated with the inquiry, or that it was unauthorized due to identity theft.

- Provide supporting evidence: Attach copies of your credit report, identification documents, or any other relevant documentation to support your claims.

- Request for investigation and removal: Clearly request the credit bureau to investigate the disputed inquiry and remove it from your report if it’s found to be inaccurate or unauthorized.

- Closing paragraph: Thank the credit bureau for their time and attention to this matter, and state that you look forward to their prompt response.

- Your signature: Sign your name and date the letter.

Step 4: Send Your Letter

After writing your letter, send it via certified mail with return receipt. This provides you with proof of delivery and can be helpful in the dispute process.

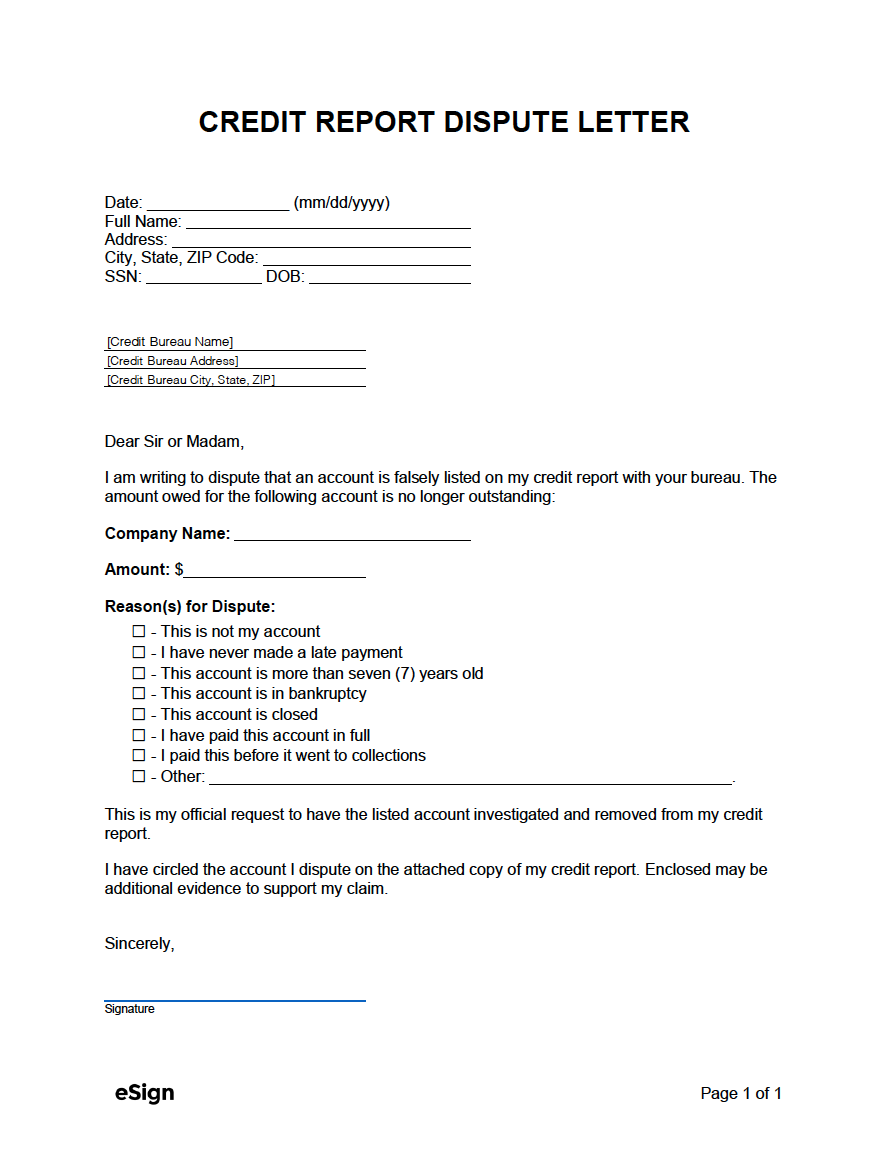

Dispute Credit Inquiry Removal Letter Template

Here’s a sample template to get you started:

Dispute Credit Inquiry Removal Letter Template

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address][Date]

[Credit Bureau Name]

[Credit Bureau Address]Subject: Dispute Credit Inquiry – [Your Account Number]

Dear [Credit Bureau Representative],

This letter is to formally dispute a hard credit inquiry on my credit report that I believe to be inaccurate and unauthorized.

On [Date of Inquiry] a hard inquiry was placed on my credit report for [Name of Lender or Company]. The inquiry refers to an application for [Type of Credit Product] that I did not submit. [Provide details of why you are disputing the inquiry, such as: I have never applied for credit with this company, or I am a victim of identity theft and did not authorize this inquiry]. I have attached copies of [Credit Report/Identification documents/Other Relevant Evidence] to substantiate my claim.

I request that you promptly investigate this disputed inquiry and remove it from my credit report.

Thank you for your time and attention to this matter. I look forward to your prompt response regarding this dispute.

Sincerely,

[Your Signature]

[Your Typed Name]

This template provides a starting point. Be sure to adapt it to your specific circumstances and include any additional details that support your case.

Tips and Expert Advice for Success

Remember, a well-crafted letter is just the first step. Here are some extra tips to increase your chances of success:

- Be persistent: If you don’t hear back from the credit bureau within a reasonable timeframe, follow up with a phone call or email.

- Document everything: Keep records of all your correspondence with the credit bureau, including dates, times, and details of conversations.

- Consider professional help: If the dispute proves challenging, consider contacting a credit repair specialist or attorney.

Don’t underestimate the power of a well-constructed dispute credit inquiry removal letter. It can be a critical tool in restoring your creditworthiness and cleaning up your financial record. With the right steps and a persistent approach, you can challenge inaccurate inquiries and pave the way for a positive financial future.

Frequently Asked Questions

Q: How long does it take to resolve a credit inquiry dispute?

A: The timeframe can vary depending on the credit bureau’s procedures and the complexity of your dispute. It can take anywhere from 30 to 45 days, but could be longer in some cases.

Q: What if the credit bureau doesn’t remove the inquiry?

A: If your dispute is denied, you can file a formal complaint with the Consumer Financial Protection Bureau (CFPB) and the credit bureau. You may also have the option to pursue legal action in certain circumstances.

Q: Can I submit a dispute online?

A: Most credit bureaus offer online dispute forms for ease of submission, but you can always opt for the traditional paper approach.

Dispute Credit Inquiry Removal Letter Template

Conclusion

Disputing credit inquiries can be a daunting task, but it’s an essential step towards achieving a clean and accurate credit report. By understanding the process, crafting a powerful dispute credit inquiry removal letter, and remaining persistent, you can take control of your credit history and protect your financial health. Remember: A clean credit report is often the key to unlocking financial opportunities, so don’t be afraid to fight back against inaccurate inquiries.

Are you ready to take charge of your credit? Share your experiences with disputing credit inquiries in the comments below.