Imagine this: you’ve worked tirelessly your whole life, but unexpected circumstances have piled on debt, leaving you feeling overwhelmed and trapped. You’re not alone. Millions of Americans are struggling with debt, and the hope of financial recovery seems distant. But what if there was a way to alleviate this crushing weight, a path towards financial freedom? That’s where House Joint Resolution 192 (HJR 192) enters the picture, a controversial proposal that aims to address the growing burden of debt in America.

Image: www.scribd.com

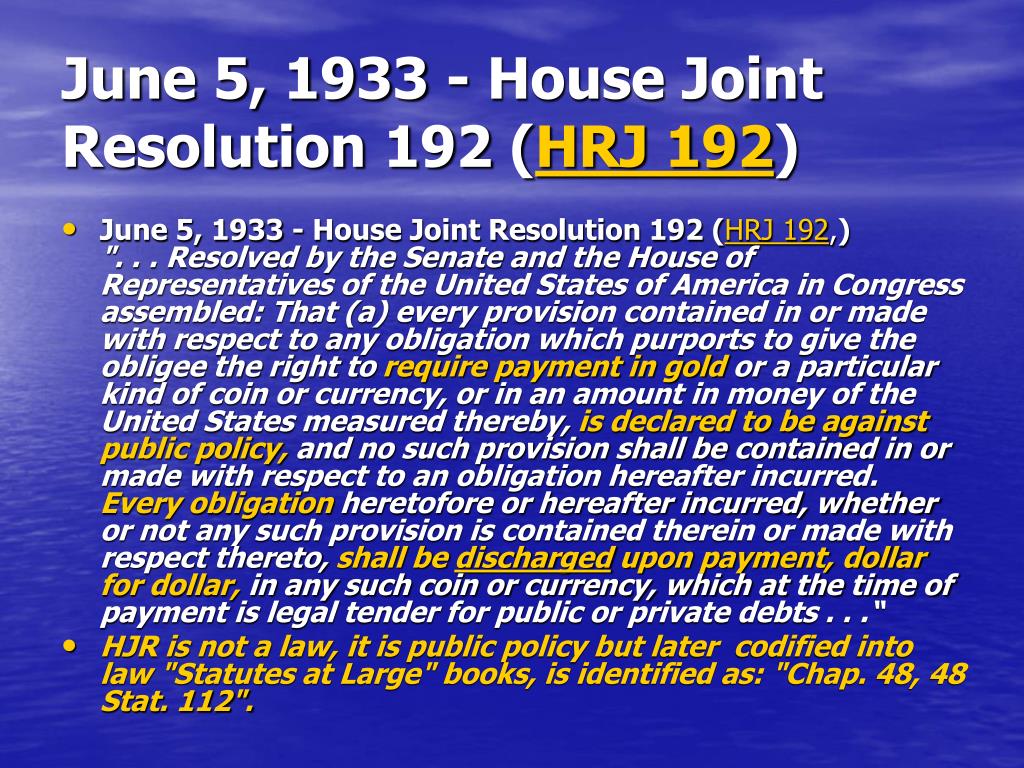

HJR 192, also known as the “Debt Relief Act,” is a legislative measure that proposes a dramatic solution: allowing the federal government to discharge the debts of Americans facing financial hardship. This seemingly radical proposition has sparked heated debate, with proponents arguing it’s a necessary measure to prevent economic crisis and critics questioning its feasibility and potential unintended consequences. But before we delve into the intricacies of this landmark resolution, let’s first understand the roots of the debt crisis that has prompted such a bold proposal.

The Debt Crisis: A Story of Our Times

The American dream, built on the promise of opportunity and upward mobility, often gets entangled with the reality of financial burdens. Student loans, medical bills, credit card debt – the weight of these obligations can be crippling, pushing individuals and families to the brink of economic ruin. The roots of this debt epidemic are multi-faceted, interwoven with the complex fabric of our economy and society.

- The Cost of Education: The soaring cost of college education has left many graduates drowning in student loan debt. While education is often touted as the key to upward mobility, the price tag attached to it can become a lifelong financial shackle.

- Healthcare Expenses: The high cost of healthcare, with its unpredictable bills and complex insurance system, is another major driver of debt. Even with insurance, unexpected medical events can devastate personal finances.

- Credit Card Debt: The convenience of credit cards can quickly turn into a trap. Easy access to credit, coupled with high-interest rates, can lead to a snowball effect of debt, trapping individuals in a cycle of borrowing and repayment.

- The Impact of Recessions: Economic downturns often leave individuals and families with reduced income and job losses, making it difficult to manage existing debt obligations.

The consequences of this debt crisis are far-reaching, affecting not only individuals but also the overall health of the economy. Families struggle to make ends meet, businesses face challenges due to consumer spending cuts, and the potential for economic growth is stifled. Recognizing the urgency of this situation, lawmakers have sought solutions, with HJR 192 emerging as a controversial but potentially game-changing proposal.

Understanding House Joint Resolution 192

HJR 192 is not just another piece of legislation; it’s a bold assertion of the federal government’s responsibility to address the debt crisis. At its core, it seeks to empower the government to discharge debt, offering a potential lifeline to millions facing financial hardship. While the specific mechanisms of implementation are still being debated, the proposition hinges on these key elements:

- The Power of the Federal Government: HJR 192 reasserts the government’s power to address debt, challenging the traditional view of debt as a solely private matter. This shift in perspective acknowledges the interconnectedness of personal debt with broader economic stability.

- Comprehensive Debt Relief: The resolution aims to encompass a broad range of debt, including student loans, medical bills, credit card debt, and even some mortgage debt. This comprehensive approach seeks to address the various forms of debt that are crippling American families.

- The Need for Criteria: While HJR 192 advocates for debt discharge, it acknowledges the need for criteria to ensure that the benefit reaches those who need it most. This could involve income thresholds, assessment of hardship, or other factors to determine eligibility.

HJR 192 has generated significant debate, with proponents highlighting its potential benefits and critics raising concerns about its potential drawbacks.

Arguments in Favor of HJR 192

Supporters of HJR 192 argue that it’s a necessary step to address the crippling debt burden facing millions of Americans. They present these compelling arguments:

- Stimulating the Economy: They believe that debt relief would put more money in the pockets of consumers, leading to increased spending and economic growth. Consumers burdened with debt often have limited discretionary income, and relieving their financial pressure could boost the economy.

- Reducing Poverty: They argue that debt relief would help families escape poverty by erasing burdensome obligations that prevent them from achieving financial stability. Debt can trap individuals in a cycle of poverty, and HJR 192 could offer a path towards upward mobility.

- Addressing Systemic Issues: They view debt relief as a way to address the systemic issues that contribute to the debt crisis, such as the high cost of education and healthcare. They argue that debt relief provides a temporary solution while addressing the underlying issues that drive debt.

Image: www.slideserve.com

Concerns Around HJR 192

Critics of HJR 192 express serious concerns about its potential consequences, arguing that it could have unintended negative effects on the economy and financial system.

- Moral Hazard: They argue that debt relief could create a “moral hazard,” where individuals become less responsible with borrowing knowing that their debt could be discharged. This could lead to increased borrowing and further exacerbate the debt crisis.

- Impacts on Credit Markets: They worry that debt relief could disrupt credit markets, making lenders less willing to extend credit because they fear the possibility of non-repayment. This could make it more difficult for individuals to obtain loans, especially those with lower credit scores.

- The Cost of Debt Relief: Critics highlight the significant financial costs associated with debt relief, arguing that it could lead to increased taxes or cuts in other government programs. The government would need to find a way to fund the debt discharges, which could involve burdening taxpayers.

The Future of Debt Relief: A Complex Path Forward

The debate over HJR 192 reflects the complex challenges surrounding debt in America. While the proposal offers a glimmer of hope for those struggling with debt, it also raises significant concerns about unforeseen consequences. The path forward will involve a careful balancing act, considering the potential benefits of debt relief while addressing the concerns about its impact on the economy and financial system.

Expert Insights and Actionable Tips

While HJR 192 is still under debate, experts in the fields of finance, economics, and public policy offer crucial insights:

- Consider Your Options: Whether or not HJR 192 passes, it’s crucial to be proactive about your debt. Explore options like debt consolidation, credit counseling, and negotiation with creditors before resorting to drastic measures.

- Stay Informed: Keep up-to-date on the latest developments of HJR 192 and other debt relief initiatives. It’s essential to understand the potential implications so you can make informed decisions about your finances.

House Joint Resolution 192 Discharge Debt

Conclusion

House Joint Resolution 192 represents a bold attempt to address the growing burden of debt in America. It offers a potential lifeline for those struggling with crushing debt, but it also raises questions about its feasibility and potential unintended consequences. The future of debt relief remains uncertain. However, understanding the complexities of this legislation and exploring available resources is essential for individuals and families looking for solutions to their debt problems. Whether HJR 192 becomes law or not, taking control of your finances is crucial and seeking help from financial advisors or counselors can be a wise step towards a brighter financial future.