Ever received a check and felt a little intimidated by the blank canvas of its face? This simple piece of paper can represent a financial reward, a debt payment, or even a gift. But before you can enjoy the benefits of your check, you need to know how to fill it out properly. No need to worry, writing a check is easier than it seems, and this guide will be your friendly companion through the process.

Image: adultosporpooda.weebly.com

In this article, we’ll delve into the world of checks, focusing on how to fill out a check in English. We will cover essential parts of a check, different types of checks available, common mistakes to avoid, and important security tips to keep your funds safe. Whether you’re a student making your rent payment or a seasoned professional handling business transactions, this guide will equip you with the knowledge to handle your checks confidently.

Understanding the Basics: Anatomy of a Check

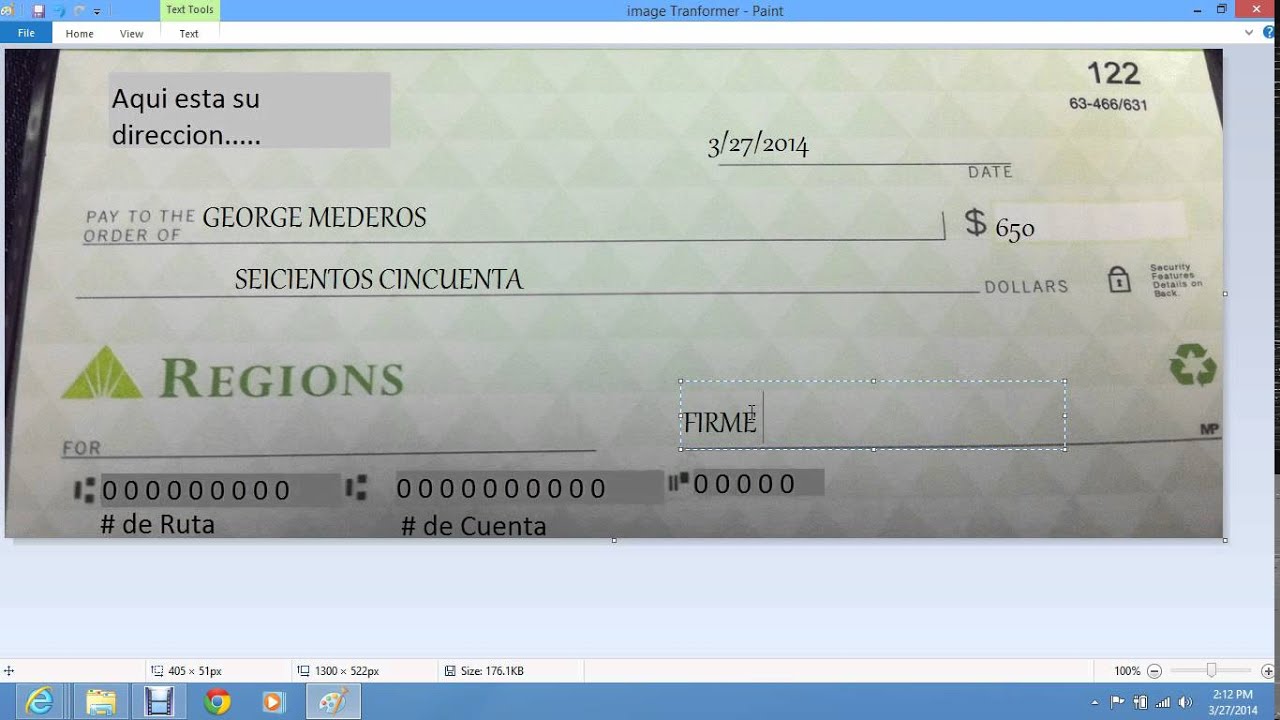

Before we dive into filling out a check, let’s get acquainted with its key components:

- Check Number: This is a unique number assigned to each check, usually located in the upper right corner. It helps you track your checks.

- Date: Write the current date. Always write the full date in the format, e.g., July 15, 2023.

- Payee: This is the name of the person or organization receiving the check. Write the name clearly and legibly.

- Amount in Numbers: This is where you write the amount of money being paid in numerical form. Be precise and use only numerals. For example, write $100.00.

- Amount in Words: This is where you write the amount of money being paid using words. This helps prevent any potential fraud. For example, write “One Hundred Dollars and 00/100.”

- Memorandum Line: This is an optional line where you can note the purpose of the check, such as “Rent Payment” or “Invoice #123.”

- Signature Line: This is where you sign your name. Make sure your signature is clear and legible.

- Account Number: This is your bank account number, usually found at the bottom of the check.

- Routing Number: This is a nine-digit number that identifies your bank. It’s typically found at the bottom of the check, usually near your account number.

Writing a Check in English: A Step-by-Step Guide

Let’s go through the process of filling out a check in English:

1. Date the Check

Start by writing the current date in the top right corner. For example, “July 27, 2023.” Always write the full date, including the month, day, and year. This is an important step for accurate record-keeping and potential legal purposes.

Image: proper-cooking.info

2. Write the Payee’s Name

Now, write the name of the person or organization receiving the check clearly in the “Pay to the order of” line. Double-check the spelling to avoid any confusion or delays in processing the check. Make sure to write this name legibly and avoid any ambiguity.

3. Fill In the Amount in Numbers

Next, write the amount of money you are paying using numbers. Use numerals to write the amount, aligning the dollar sign ($) and decimal point (.) accurately. For instance, for two hundred dollars and fifty cents, write “$200.50.”

4. Write the Amount in Words

Now, write the amount of money you are paying in words on the line below the numerical amount. Write this carefully, spelling out the amount correctly. Use the word “and” to represent the decimal point. For example, for $200.50, you would write “Two Hundred Dollars and 50/100”

5. Add a Note (Optional)

If you want to include a note about the purpose of the check, you can do so in the “Memorandum” or “Memo” line. This can include a brief explanation of the payment, such as “Rent” or “Invoice #123.” This helps with easier reconciliation in the future.

6. Sign Your Name

Finally, sign your name in the signature line with a blue or black pen. Make sure your signature is legible and in your usual style. This is an important step both for authentication and for your bank to process the check correctly.

Types of Checks: Expanding Your Options

While standard checks are common, various types of checks are available to fit different needs, including:

- Traveler’s Checks: These checks are pre-printed with an amount and can be exchanged for local currency at banks or exchange bureaus in many countries.

- Cashier’s Checks: These checks are guaranteed by the bank and are typically used for significant transactions like car purchases or real estate investments.

- Money Orders: These checks are similar to cashier’s checks but are typically issued by post offices or other financial institutions.

Common Mistakes to Avoid

While filling out a check may seem straightforward, be mindful of these common mistakes that can lead to delays and problems:

- Incorrect Date: Double-check the date. An incorrect date can cause delays or even return the check to you.

- Spelling Errors: Ensure the payee’s name is spelled correctly. Misspellings can result in the check being sent to the wrong person or organization.

- Missing Information: Carefully check all required boxes and make sure no crucial information is missing.

- Illegible Writing: Use clear, legible writing for all information on the check. Illegibility can make it difficult for the bank to process the check.

Security Tips: Protecting Your Check

Here are some tips to keep your checks and financial information secure:

- Keep Checkbooks Safe: Store your checkbook in a secure location, away from prying eyes. This helps prevent anyone from accessing your checks.

- Use Safety Features: Many checks include security features or watermarks. Check that your checks have such features to help minimize fraud.

- Report Lost or Stolen Checks: Report any lost or stolen checks to the bank immediately. They will typically cancel the checks and issue new ones to prevent fraudulent use.

- Monitor Bank Statements: Regularly review your bank statements for any discrepancies or unauthorized transactions. If you spot something unusual, contact your bank promptly.

Como Llenar Un Cheque En Ingles

Conclusion

Knowing how to fill out a check in English is an essential skill, especially with checks still playing a significant role in various financial transactions. This guide has provided you with the necessary steps and tips to write a check confidently and correctly. Remember to double-check all the information before submitting your checks to avoid errors, and stay vigilant about security measures to safeguard your funds.

For more information on checking accounts and other financial products, consult your local bank or research online resources for valuable insights. By mastering the art of check writing and implementing essential security practices, you can easily navigate financial transactions, ensuring clarity and peace of mind.