Imagine this: you’re enjoying a leisurely walk in the park, basking in the warm sunshine, when suddenly, a rogue frisbee comes hurtling towards you, knocking you off your feet. Your ankle twists, sending a jolt of pain through your body. You’re left with a throbbing injury and a mountain of questions: “How will I get home?” “How will I pay for treatment?” “What about lost time from work?” This unsettling experience highlights the importance of having a safety net, a way to weather life’s unpredictable storms. That’s where “Live Life” claim forms come in. But what exactly are they, and how can they help you during these challenging moments?

Image: www.signnow.com

This guide will delve into the world of “Live Life” claim forms, demystifying their purpose and empowering you to navigate potential life hurdles with confidence. We’ll explore the types of claims you can file, the essential information needed, and the steps to successfully complete a form. Whether you’re facing an unexpected accident, a medical emergency, or a critical financial challenge, understanding “Live Life” claim forms can provide you with much-needed peace of mind and financial support.

Deciphering the World of “Live Life” Claims

“Live Life” claims are a lifeline in times of unforeseen events. They refer to a range of insurance policies designed to cover various life situations, from unexpected accidents to sudden illnesses. These policies are often bundled with other services like health insurance, life insurance, or travel insurance, providing a comprehensive safety net for individuals and families.

Navigating the Labyrinth: Types of “Live Life” Claims

The world of claims can be overwhelming, but understanding the different categories can simplify the process. Here’s a breakdown of some common “Live Life” claim types:

- Accident Claims: These claims cover injuries sustained due to unforeseen incidents like car accidents, slip-and-falls, or medical mishaps. Depending on the policy, you might receive coverage for medical expenses, lost wages, and even rehabilitation expenses.

- Illness Claims: These claims offer financial assistance during unexpected illnesses like a serious diagnosis or a lengthy hospitalization. You might receive coverage for medical expenses, therapies, and potential lost income.

- Disability Claims: These claims provide support for individuals who become unable to work due to a long-term injury or disability. The policy may cover a percentage of your lost income, ensuring financial stability during this challenging period.

- Critical Illness Claims: These claims provide a lump sum payment upon diagnosis of a life-threatening illness like cancer, heart attack, or stroke. This financial assistance can help you focus on treatment and recovery without the added stress of financial burdens.

Finding the Right Fit: Understanding Your Policy

Before submitting a claim, it’s crucial to understand the specifics of your policy. Carefully review the policy document, paying attention to:

- Covered Events: Identify the events that are covered by your policy, including any exclusions or limitations.

- Claim Procedures: Familiarize yourself with the process for filing a claim, including deadlines and required documentation.

- Claim Limits: Note the maximum benefits you can claim for each covered event, ensuring you understand the financial limits.

- Contact Information: Record the contact details of your insurance provider, including their phone number, email address, and website.

Image: templates.rjuuc.edu.np

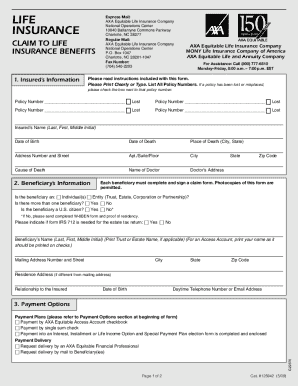

Unlocking the Information: Completing the “Live Life” Claim Form

The “Live Life” claim form is your gateway to accessing the benefits you deserve. It asks for specific information about the event, your medical history, and your financial situation. Here’s a breakdown to guide you through the form:

- Personal Information: This section gathers your name, address, contact details, and policy details.

- Event Details: This section requires you to describe the event that led to the claim, including the date, time, and location.

- Medical Information: This section requests details about your injury or illness, including a diagnosis, treatment history, and prognosis.

- Financial Information: This section gathers data about your income, expenses, and any potential financial losses due to the event.

Submitting Your Claim: The Final Steps

Once you’ve completed the claim form, double-check all the details for accuracy. Ensure all required documentation is attached, including:

- Medical Reports: Include reports from doctors, hospitals, therapists, or any other healthcare providers involved in your treatment.

- Other Supporting Evidence: Depending on the claim, you may need to provide evidence like police reports, accident reports, or witness statements.

- Financial Documentation: Include proof of income, expenses, and any potential financial losses, like lost wages.

Navigating the System: Tips for Successful Claim Processing

- Be Prompt: Submit your claim form as soon as possible after the event, adhering to the policy deadlines.

- Be Detailed: Provide clear and accurate information about the event, your injuries, and your medical treatment.

- Be Patient: Allow sufficient time for the insurance provider to process your claim. Remember, insurance claims can involve multiple steps and parties.

- Communicate Effectively: Maintain open communication with your insurance provider, addressing any questions or concerns promptly.

Unlocking Expert Insights: Finding the Right Path

If you’re facing a “Live Life” claim, seeking professional advice can make a world of difference. An experienced insurance claims specialist can provide valuable guidance on:

- Understanding Your Policy: They can help you decipher the complicated language of your policy, ensuring you understand your rights and benefits.

- Completing the Claim Form: They can assist in completing the form accurately, increasing your chances of a smooth and successful claim.

- Negotiating with Your Insurance Provider: If you encounter difficulties, they can advocate on your behalf, ensuring you receive the support you deserve.

Live Life Claim Form Pdf Free

Live Life, Fearlessly and Securely

“Live Life” claim forms are an invaluable tool, offering you a safety net in life’s unexpected moments. Understanding these forms, knowing your rights, and seeking professional guidance can empower you to navigate these challenges with confidence and ease. By taking proactive steps to learn about your policy and understand the claim process, you can ensure that you’re equipped to handle any unexpected event with grace and resilience. Remember, embracing a secure future means living life to the fullest, knowing you have a reliable safety net in place.