Imagine this: you’ve diligently paid your bills on time, but suddenly an unexpected expense throws your budget into chaos. You find yourself struggling to make ends meet, and the thought of falling behind on your payments sends shivers down your spine. What if there was a way to alleviate this financial pressure? Enter the world of offsetting payments, a potentially powerful tool that can offer much-needed relief during challenging times.

Image: www.hotzxgirl.com

This article dives deep into the concept of offsetting payments, providing a comprehensive guide to navigating this financial maneuver. We’ll explore the intricacies of crafting a sample request letter to offset payment, offering practical tips and expert insights to ensure you present your case effectively. Whether you’re dealing with a temporary financial hardship or seeking to manage your finances more efficiently, this guide will empower you to take control and find a path towards financial stability.

Understanding Offset Payments

Offsetting payments, in essence, involves using an existing payment to reduce the amount owed on another debt. This practice can be particularly beneficial for individuals navigating financial difficulties. While it might not completely eliminate debt, it allows individuals to prioritize essential payments, thus preserving their financial standing.

For instance, imagine you face a mounting debt on your credit card while simultaneously struggling to keep up with your mortgage payments. You might consider asking your lender to use a portion of your available savings or a portion of a future payment on your mortgage to offset the outstanding credit card debt, relieving immediate financial stress.

Types of Offset Payments

Offsetting payments are often associated with debt, but their application can extend to other financial situations. Here’s a breakdown of common offsetting scenarios:

- Debt Offset: This refers to applying an existing payment towards a different outstanding debt, potentially reducing the overall debt burden.

- Overpayment Offset: If you’ve made an overpayment on a specific account (such as a utility bill), you might request to have this surplus applied to another outstanding payment.

- Refund Offset: In some cases, government agencies might offset tax refunds or other government payments towards outstanding debts like student loans or child support.

When to Consider an Offset Payment

While offsetting payments can be a valuable tool, it’s crucial to understand when this option is most beneficial. Here are some key scenarios where seeking an offset might be advantageous:

- Temporary Financial Hardship: An unexpected job loss, medical emergency, or natural disaster can disrupt your financial stability. Offsetting existing payments can help manage expenses during this period of difficulty.

- Debt Consolidation: Consolidating multiple debts into a single loan can often offer lower interest rates. However, you might find it beneficial to offset existing payments towards the consolidated loan to accelerate its repayment.

- Financial Management: Strategically offsetting payments can help you prioritize essential expenses, such as housing and utilities, while managing other debts effectively.

Image: www.pinterest.com

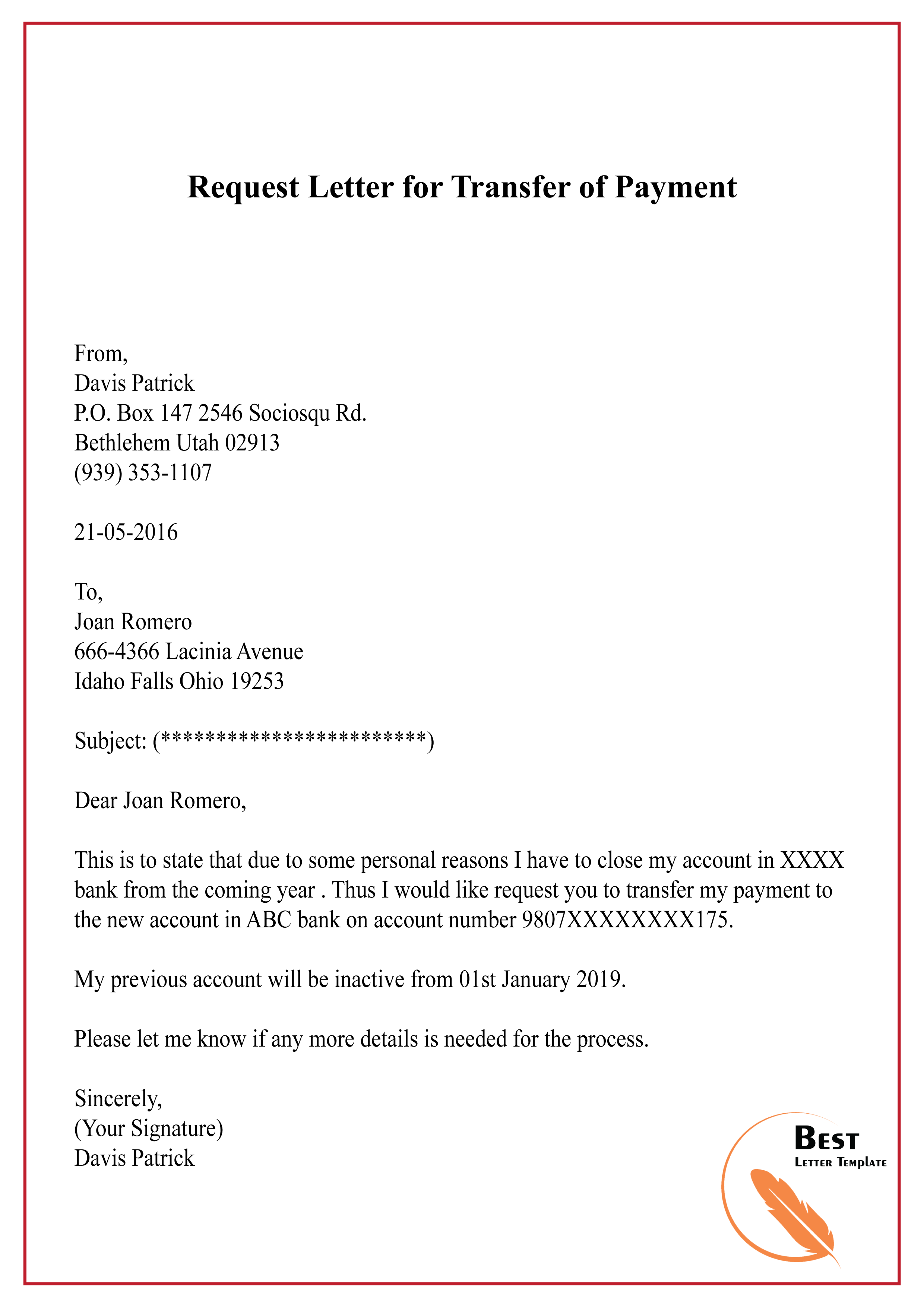

Crafting a Sample Request Letter

Now that you understand the basics of offset payments, let’s delve into the crucial step of crafting a persuasive request letter. A well-written letter can make a significant difference in influencing the decision-maker. Here’s a sample request letter to offset payment that you can use as a starting point:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient Name]

[Recipient Title]

[Company Name]

[Company Address]

Subject: Request to Offset Payment

Dear [Recipient Name],

This letter is to formally request an offset payment for my [Account Type – e.g., credit card, student loan, utility bill] account number [Account Number].

For the past [Number] years, I have maintained a consistent payment history for my [Account Type] with [Company Name]. However, due to [Explain the Reason – temporary financial hardship, debt consolidation, etc.], I am currently facing a financial challenge and need to prioritize my payments.

[Provide context for your request and explain why offsetting payments is necessary. Be specific and provide relevant details.]

Therefore, I kindly request that you consider offsetting [Specific Amount] from my [Account Type] account to my [Account Type] account number [Account Number] to alleviate my immediate financial burden.

I am confident that this offset arrangement will allow me to remain current on my financial obligations and prevent any future disruptions to my payment history with [Company Name].

Thank you for your time and consideration. I look forward to your prompt response and a positive resolution.

Sincerely,

[Your Signature]

[Your Typed Name]

Key Components of a Strong Request Letter

While this sample letter provides a solid framework, here are some vital aspects to emphasize to ensure your request resonates:

- Professionalism and Clarity: Maintain a professional tone throughout the letter. Use concise and clear language, free from any jargon or ambiguity.

- Provide Specific Details: Be specific about your request, including the amount you wish to offset, the account numbers involved, and the type of offsetting you desire (e.g., debt offset, overpayment offset).

- Justify Your Request: Explain your financial situation clearly and honestly. Highlight any extenuating circumstances, whether it’s a temporary hardship or a strategic financial move.

- Offer a Solution: Suggest a realistic and workable solution for offsetting the payments. This demonstrates your commitment to managing your finances responsibly.

- Maintain a Positive Tone: Even while addressing a potentially sensitive topic, maintain a polite and respectful tone. Avoid making demands or accusations.

- Proofread Thoroughly: Before sending your letter, meticulously proofread it for grammatical errors, spelling mistakes, and inconsistencies.

Expert Insights on Offset Payments

While offsetting payments can be a valuable tool, it’s important to seek guidance from financial experts to ensure you’re making informed decisions. Remember, this practice may not be an immediate solution for every financial challenge and could potentially impact your credit score.

- Consult a Financial Advisor: A qualified financial advisor can provide personalized recommendations tailored to your specific situation. They can help assess whether offsetting payments aligns with your financial goals and can explore alternative strategies if necessary.

- Review Your Credit Score: Understand the potential impact of offsetting payments on your credit score. Some offsetting practices might affect your credit history, especially when involving debt consolidation or other complex financial maneuvers.

Sample Request Letter To Offset Payment

Leveraging Offset Payments for Financial Success

Offsetting payments can be a powerful tool for navigating financial challenges and achieving financial stability. By understanding the intricacies of this practice and crafting a compelling request letter, you can proactively address financial difficulties and position yourself for future financial success.

Remember, offsetting payments should be considered thoughtfully and within the context of your individual financial circumstances. Consulting with a financial advisor or seeking guidance from trusted financial institutions can empower you to make informed decisions and find the most effective solutions for your unique situation.

By taking a proactive approach to managing your finances, you can unlock the potential of offsetting payments and achieve long-term financial well-being.