Remember that time you bought a vintage record player at a flea market for a few bucks, only to find out later that it was a rare collector’s item worth a small fortune? You might not have planned on making a profit, but that’s a perfect example of a high rate of return – a major win for your wallet! Understanding how to calculate and interpret your rate of return is crucial, whether you’re a seasoned investor or just starting out. It’s the compass that helps you navigate the world of finance and understand how your investments are performing.

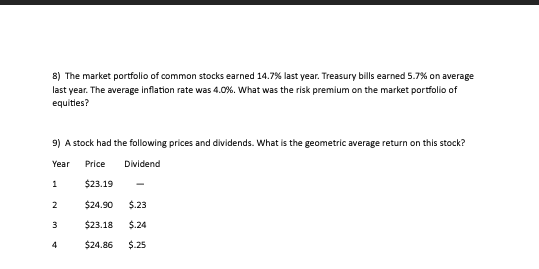

Image: www.chegg.com

In this blog post, we’ll dive into the world of rate of return, exploring its definition, significance, and practical applications. We’ll cover Chapter 3, Lesson 6 of your financial learning journey, outlining the essential concepts and formulas you need to know. By the end of this post, you’ll be equipped to calculate your returns and make informed decisions about your investments.

What is Rate of Return?

Imagine putting a certain amount of money into a savings account or buying a stock. Over time, the value of your investment goes up or down. The rate of return measures the change in value of your investment, expressed as a percentage. This percentage tells you how much your initial investment has grown or shrunk in relation to the original amount.

For example, if you invested $1,000 and it grew to $1,100, your rate of return would be 10% – a simple calculation of ($1,100 – $1,000) / $1,000 multiplied by 100. This percentage represents your gain over the investment period.

Understanding the Concept

The Importance of Rate of Return

Rate of return is the bedrock of investment analysis. It helps you evaluate the performance of your investments and compare them to other options. A higher rate of return generally indicates better investment performance. This metric is essential for:

- Making Investment Decisions: Knowing your rate of return allows you to assess if your investments are meeting your financial goals.

- Comparing Investment Options: It enables you to evaluate different investments side-by-side and choose the ones with the most potential for growth.

- Tracking Investment Progress: Rate of return provides a clear picture of how your investments are performing over time, allowing you to adjust your strategy if needed.

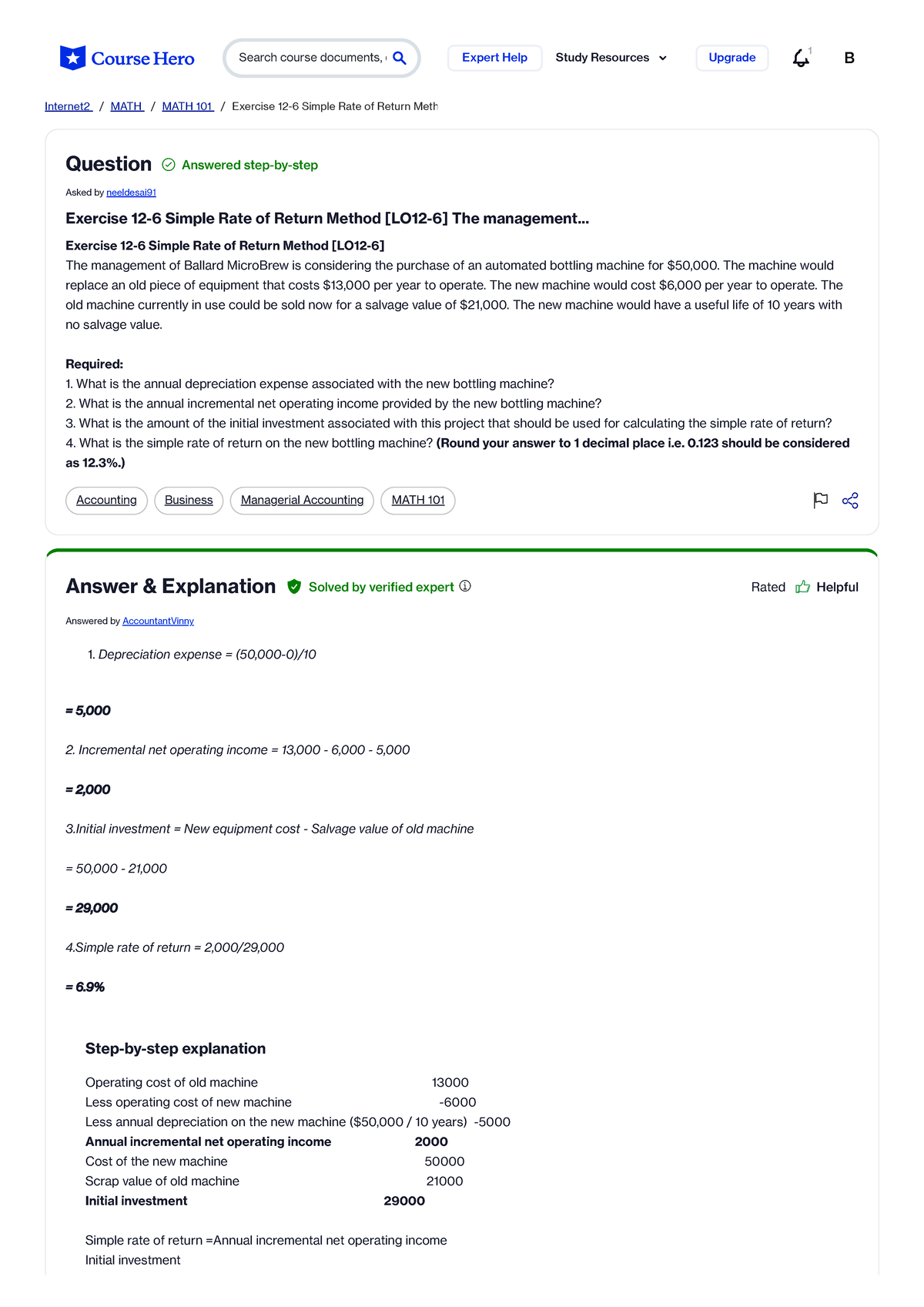

Image: www.studocu.com

Types of Rate of Return

There are various ways to calculate rate of return, depending on the type of investment and the factors you want to consider. Some key types include:

- Simple Rate of Return: This is the most basic form and considers only the initial investment and the final value.

- Annualized Rate of Return: This form considers the time value of money, adjusting the return over multiple years to reflect the compounding effect of interest.

- Real Rate of Return: This takes inflation into account, showing the true purchasing power of your investment gains after adjusting for inflation.

Calculating Rate of Return: Chapter 3, Lesson 6

The Formula

The basic formula for calculating rate of return is:

(Final Value – Initial Value) / Initial Value × 100 = Rate of Return

Here’s how to break down the calculation using a practical example:

Let’s say you purchased 100 shares of a company at $20 per share, for a total investment of $2,000 (100 shares x $20). After a year, the price per share increases to $25. Your total investment is now worth $2,500 (100 shares x $25). To calculate your rate of return, you would use the following steps:

- Calculate your final value: 100 shares x $25 = $2,500

- Subtract the initial value from the final value: $2,500 – $2,000 = $500

- Divide the difference by the initial value: $500 / $2,000 = 0.25

- Multiply by 100 to get the percentage: 0.25 x 100 = 25%

Therefore, your rate of return on this investment is 25% for the year. This means your initial investment grew by 25% over the period.

Key Considerations

Keep in mind that rate of return is not the only factor to consider when evaluating an investment. Other vital elements include risk, liquidity, and tax implications. Here are some important points to remember:

- Time Period: Rate of return can vary widely depending on the investment timeframe. A high return over a short period might not be as impressive as a steady return over a long-term investment horizon.

- Risk: Investments that offer potentially high returns often carry higher risks of losses. A balanced approach to risk management is essential for achieving your financial goals.

- Fees and Expenses: Don’t forget to factor in transaction fees, management fees, and other expenses that can impact your overall rate of return.

Tips and Expert Advice

Incorporating these tips into your investment approach can help you maximize your returns:

- Invest for the Long Term: Market fluctuations are inevitable. Long-term investing allows you to ride out short-term volatility and benefit from compounding returns.

- Do Your Research: Before making any investments, thoroughly research the company, industry, and asset class.

- Diversify: Spread your investments across different asset classes to reduce risk and enhance the potential for achieving your financial goals.

- Seek Professional Guidance: Consider talking to a financial advisor who can offer personalized advice based on your financial circumstances and investment goals.

Remember, investing is a marathon, not a sprint. Be patient, stay disciplined, and consistently review your investment strategy. Regularly monitoring your portfolio’s performance, including calculating your rate of return, will help you stay on track and make informed adjustments along the way.

FAQs

Q: Can rate of return be negative?

A: Yes, if the final value of your investment is less than the initial value, the rate of return will be negative, indicating a loss.

Q: What is a good rate of return?

A: A good rate of return depends on several factors, including your risk tolerance, investment timeframe, and the current market conditions. However, historically, the stock market has averaged an annual return of around 10%.

Q: How often should I calculate my rate of return?

A: It’s a good practice to calculate your rate of return at least annually or even quarterly to monitor the performance of your portfolio.

Rate Of Return Chapter 3 Lesson 6

Conclusion

Understanding rate of return is a crucial skill for any investor. It empowers you to track your investment progress, compare different options, and make informed decisions. Remember to consider various factors, including risk, time horizon, and fees, when assessing your returns. By staying informed, disciplined, and focused on long-term goals, you can maximize your investment potential.

Are you interested in learning more about rate of return and exploring other key financial concepts? Let us know in the comments below!