The allure of “one trading setup for life” is a powerful one. We all yearn for that magical formula, that key that unlocks consistent profits in the often chaotic world of finance. While the idea might seem elusive, it’s not entirely out of reach. ICT Mentorship 2023, a program focused on the principles of “Intermarket Correlation Trading,” offers a system that aims to be just that – a foundational setup for building long-term trading success.

Image: threadreaderapp.com

But let’s be upfront. No trading approach guarantees a flawless win record. Market dynamics are complex, and unforeseen events can always throw a wrench into even the most well-crafted strategies. Still, ICT Mentorship presents a thought-provoking approach rooted in understanding the interconnectedness of markets.

Understanding Intermarket Correlation Trading

ICT: A Paradigm Shift

Traditional technical analysis often focuses on individual markets in isolation. ICT Mentorship emphasizes a shift in perspective. This approach highlights that markets are interconnected, and movements in one market can significantly influence others. Think of it as a web, where pulling on one thread can reverberate across the entire structure. Understanding these correlations allows traders to potentially anticipate market shifts and potentially capitalize on them.

Key Elements of ICT:

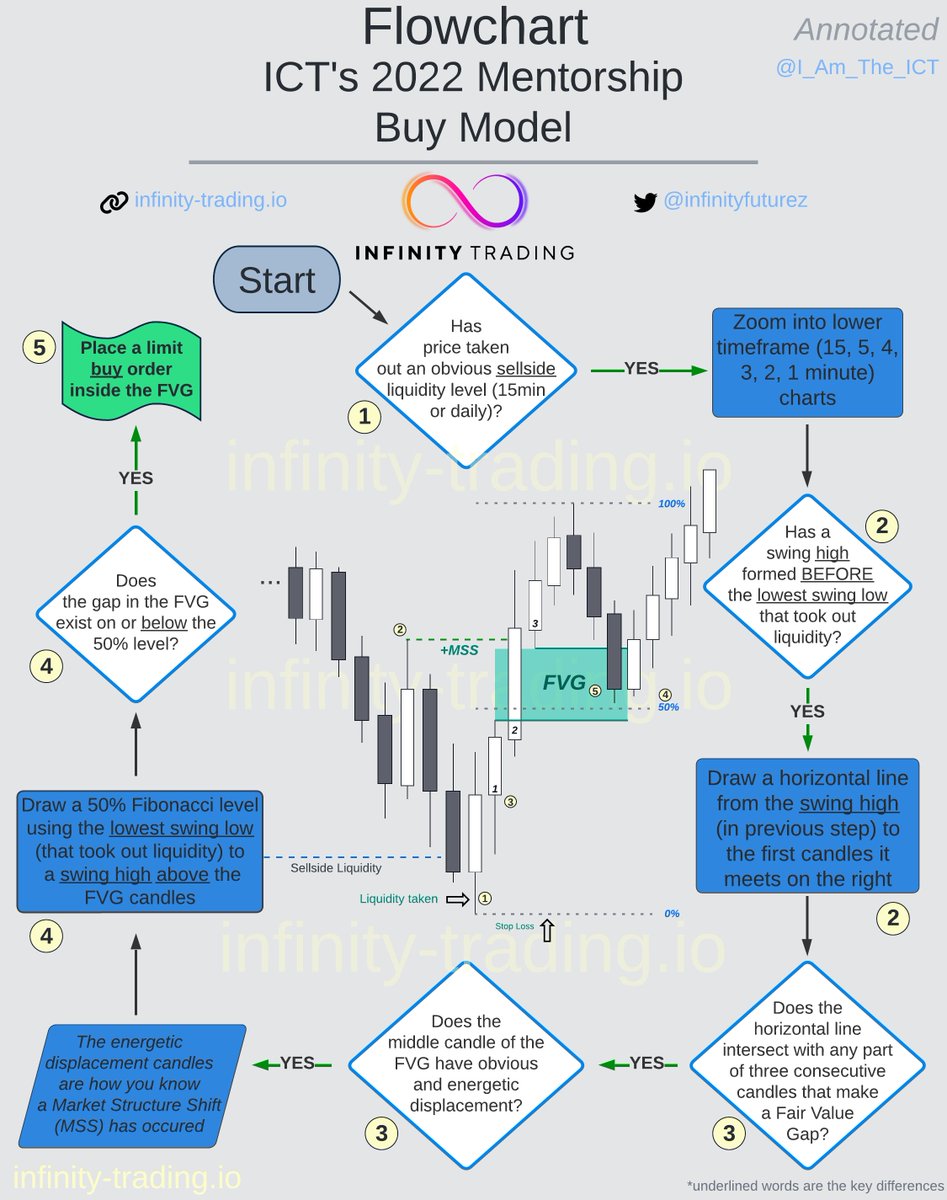

ICT utilizes a confluence of factors, drawing insights from:

- Technical Analysis: Identifying patterns and trends in price action.

- Fundamental Analysis: Analyzing economic data, news events, and geopolitical developments.

- Market Sentiment: Gauging investor psychology and its impact on market direction.

- Correlation Analysis: Identifying relationships between different asset classes, commodities, indices, etc.

Image: twitter.com

Putting ICT into Practice:

ICT Mentorship provides its participants with framework through which to structure their trading plans. The emphasis on intermarket analysis allows traders to potentially identify potential opportunities early on, before the majority of the market may have recognized them. This, in theory, could lead to more favorable entry and exit points.

Let’s imagine a scenario where the US dollar index weakens. An ICT trader might anticipate a consequent rise in commodity prices (such as gold) or a decline in risk-off assets (like the Japanese Yen) due to the interconnected nature of these markets. Recognizing these potential relationships can be the cornerstone of a successful trading strategy.

ICT Mentorship 2023: A Closer Look

The Program’s Core Tenets:

ICT Mentorship 2023 aims to provide traders with a comprehensive understanding of intermarket correlation trading, including:

- In-depth ICT education: Comprehensive training materials covering the theoretical foundations of ICT.

- Practical application: Real-world examples and case studies illustrating how to use ICT in different market scenarios.

- Mentorship and support: Access to experienced mentors for guidance, feedback, and support throughout the learning journey.

- Community engagement: Opportunities to connect and learn from other traders within the ICT community.

Is it for Everyone?

While ICT Mentorship presents an intriguing approach, it’s crucial to understand that it might not be appropriate for every trader. ICT trading requires a deeper understanding of market dynamics and a willingness to embrace complexity. It might be more suited for those with a strong foundation in technical analysis and a desire to expand their perspectives on market behavior.

Tips and Expert Advice for Successful ICT Trading

1. Focus on Quality, Not Quantity

Don’t be tempted to chase every correlation. Select a few key markets that you understand, focusing on relationships that have strong historical evidence.

2. Backtest and Optimize

ICT setups are dynamic. Backtesting your strategies with historical data can help refine your understanding of market interactions and identify potential areas for improvement.

3. Be Disciplined and Patient

ICT setups might not always present immediate opportunities. Be patient and adhere to your pre-defined entry and exit criteria, resist the urge to overtrade, and let your strategy take its course.

FAQs about ICT Mentorship 2023

Q: Is ICT Mentorship suitable for beginners?

A: While the program provides foundational knowledge, it’s likely more beneficial for those with some existing trading experience and a basic understanding of technical analysis.

Q: What are the potential risks of ICT trading?

A: Markets are inherently unpredictable. ICT, while aiming to provide insights, doesn’t eliminate risk. Proper risk management strategies remain essential.

Q: What are the costs associated with ICT Mentorship?

A: The program’s costs can vary depending on specific offerings. It’s advisable to visit the ICT Mentorship website for updated pricing details.

Ict Mentorship 2023 – One Trading Setup For Life

https://youtube.com/watch?v=bj1SGPo4vqE

Conclusion

ICT Mentorship 2023 offers a unique approach to trading, encouraging a deeper understanding of market interconnections. The program might appeal to traders seeking to enhance their trading strategies and gain a more comprehensive view of market dynamics. However, it’s important to remember that consistent trading success requires dedication, continuous learning, and a rigorous approach to risk management.

Are you interested in exploring ICT Mentorship potential for your own trading journey? We’d love to hear your thoughts and experiences!