Imagine a time when the stock market was in freefall, the nation struggling to climb out of the Great Depression. Banks were failing, businesses shuttered, and hope seemed to dwindle with each passing day. This was the reality of 1933, a year that saw the birth of a critical piece of legislation that would forever alter the economic landscape of the United States – HJR 192 Public Law 73-10. More commonly known as the “Joint Resolution to Suspend the Gold Standard,” this seemingly cryptic code marked a turning point in American history, one that would empower the federal government to directly manage the nation’s financial destiny.

Image: twitter.com

While the legislation itself might seem dry and technical, its impact reverberated far beyond the halls of Congress, profoundly influencing the lives of every American citizen. Understanding its complexities and its historical context is crucial for grasping the intricate threads that bind our current economic structures, both its strengths and its weaknesses.

Navigating the Labyrinth: Unraveling HJR 192 Public Law 73-10

The year 1933 was not only a year of unprecedented economic hardship but also one of immense uncertainty and fear. The gold standard, a system that had underpinned the American economy for decades, had become a crippling weight. The U.S. currency was directly tied to the value of gold, meaning that the government’s ability to manage the money supply was limited. With the Depression raging, the Federal Reserve could not freely print money to stimulate the economy, leaving millions trapped in a cycle of unemployment and poverty.

HJR 192 Public Law 73-10 was a bold move, a dramatic step away from the gold standard that opened the door for the government to flex its monetary muscle. It severed the link between the U.S. dollar and gold, empowering the government to control the issuing of currency. This act was a radical departure from the established norm, a gamble taken in the face of an economic and social crisis.

The legislation was championed by President Franklin D. Roosevelt, a leader who believed in the power of government intervention to steer the nation out of its dire situation. The idea was to break free from the shackles of gold and inject liquidity into the economy, stimulate growth, and ultimately, restore confidence in the American financial system.

The consequences of HJR 192 Public Law 73-10 were multifaceted and far-reaching:

- The Rise of the Federal Reserve: The legislation effectively fortified the Federal Reserve’s power, allowing it to act as the central bank and manage monetary policy with greater autonomy. This created a new level of control over the money supply, influencing interest rates, inflation, and overall economic stability.

- Economic Recovery and Stability: The ability to print money allowed the government to inject much-needed liquidity into the economy. This helped to stabilize the banking system, spur investment, and stimulate economic growth, contributing to the eventual recovery from the Great Depression.

- The Birth of the Modern Monetary System: HJR 192 Public Law 73-10 marked a pivotal shift in the way the United States operated. It transformed the country from a gold-backed currency system to a fiat currency system – a system where the value of currency is determined by government decree. This change has profound consequences for our understanding of money and how it functions within the economy.

The Enduring Legacy: The Controversies and the Challenges

However, the passage of HJR 192 Public Law 73-10 was not without its critics. Many argued that it was a catastrophic miscalculation, a dangerous move that would lead to excessive inflation and undermine the value of the dollar. Over the years, the legislation has been subject to ongoing debate, with economists and historians offering diverse perspectives on its impact.

While it remains undeniable that this legislation helped to pull the country out of the dire depths of the Great Depression, it also paved the way for certain economic vulnerabilities. The ability to control the money supply, while often a tool for growth and stability, can also be a source of manipulation, potentially leading to inflation and instability. The inherent risks of government intervention are always a point of contention, and the history of HJR 192 Public Law 73-10 starkly illustrates this tension.

The legacy of HJR 192 Public Law 73-10 continues to shape our world. It serves as a reminder of the power of government intervention, its potential for both good and bad, and the necessity of careful and responsible management. It is a crucial piece of history, one that has profoundly influenced our understanding of economics, finance, and the role of government in shaping our lives.

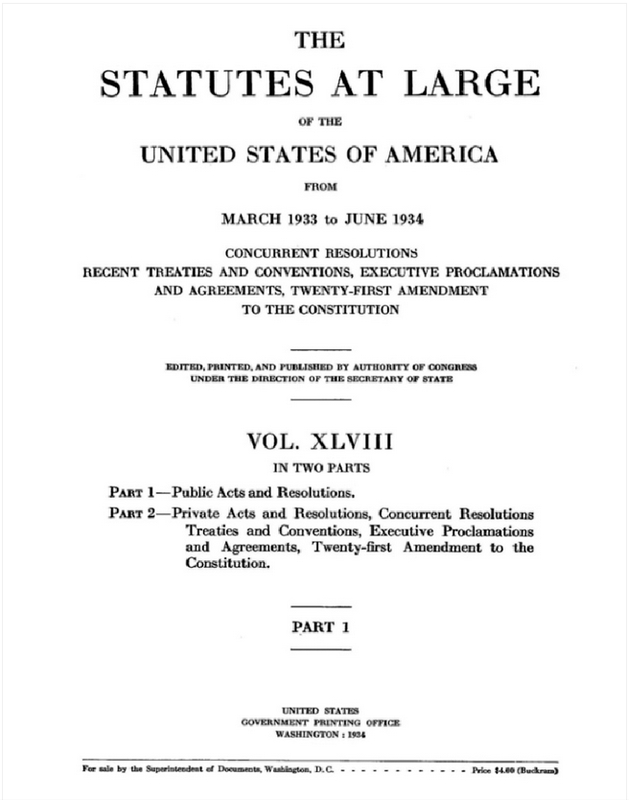

Image: ohouseolo.blogspot.com

Hjr 192 Public Law 73 10

Moving Forward: A Call to Action

The lessons of HJR 192 Public Law 73-10 are as relevant today as they were in 1933. It underscores the importance of robust financial systems, sound monetary policies, and the necessity for responsible and ethical management of resources. We must never lose sight of the power of economic legislation, its ability to both empower and endanger.

As we navigate the complex economic landscape of the 21st century, we must learn from the past, embracing a culture of informed financial literacy and responsible civic engagement. By understanding the roots of our modern financial system, we can better understand the forces that shape our economic destiny and make informed decisions about our collective future.

This is a call to action. Let us engage with the complex tapestry of our economic history, delve into the nuances of legislation like HJR 192 Public Law 73-10, and become active participants in shaping a more just and sustainable economic future for all.