Have you ever felt like you were constantly chasing markets, buying high and selling low? Do you long to understand the true mechanics of price action and gain a strategic edge in your trading? If so, then understanding the Wyckoff Methodology is an invaluable tool in your trading arsenal. This article will delve into the profound insights offered by the second edition of “The Wyckoff Methodology in Depth” by Tom Williams and explore how its teachings can help you become a more confident and successful trader.

Image: stockmarketsguides.com

The Wyckoff Methodology is a unique and powerful approach to market analysis that focuses on understanding the psychology of market participants, the accumulation and distribution of stocks, and the patterns that reveal price movements. Popularized by the pioneer of stock market analysis, Richard D. Wyckoff, this methodology helps traders identify key turning points and predict future price trends. “The Wyckoff Methodology in Depth” provides a comprehensive guide to this approach, packed with detailed explanations, real-world examples, and practical strategies.

Understanding the Wyckoff Approach

The Core Concepts

The Wyckoff Methodology is based on the idea that the market is driven by the collective action of informed operators, known as “smart money,” who aim to manipulate price in their favor. These operators accumulate shares at low prices during periods of weakness and distribute them at higher prices, leaving retail traders caught in the middle. The Wyckoff method helps traders decipher this game of supply and demand by understanding the following core concepts:

- Accumulation: This phase is characterized by a gradual upward trend as smart money accumulates shares, hidden under the guise of relative weakness. The goal is to create a foundation for a future upward move.

- Distribution: This phase is the opposite of accumulation, where smart money distributes their shares at higher prices, often under the guise of strength, ultimately preparing for a decline.

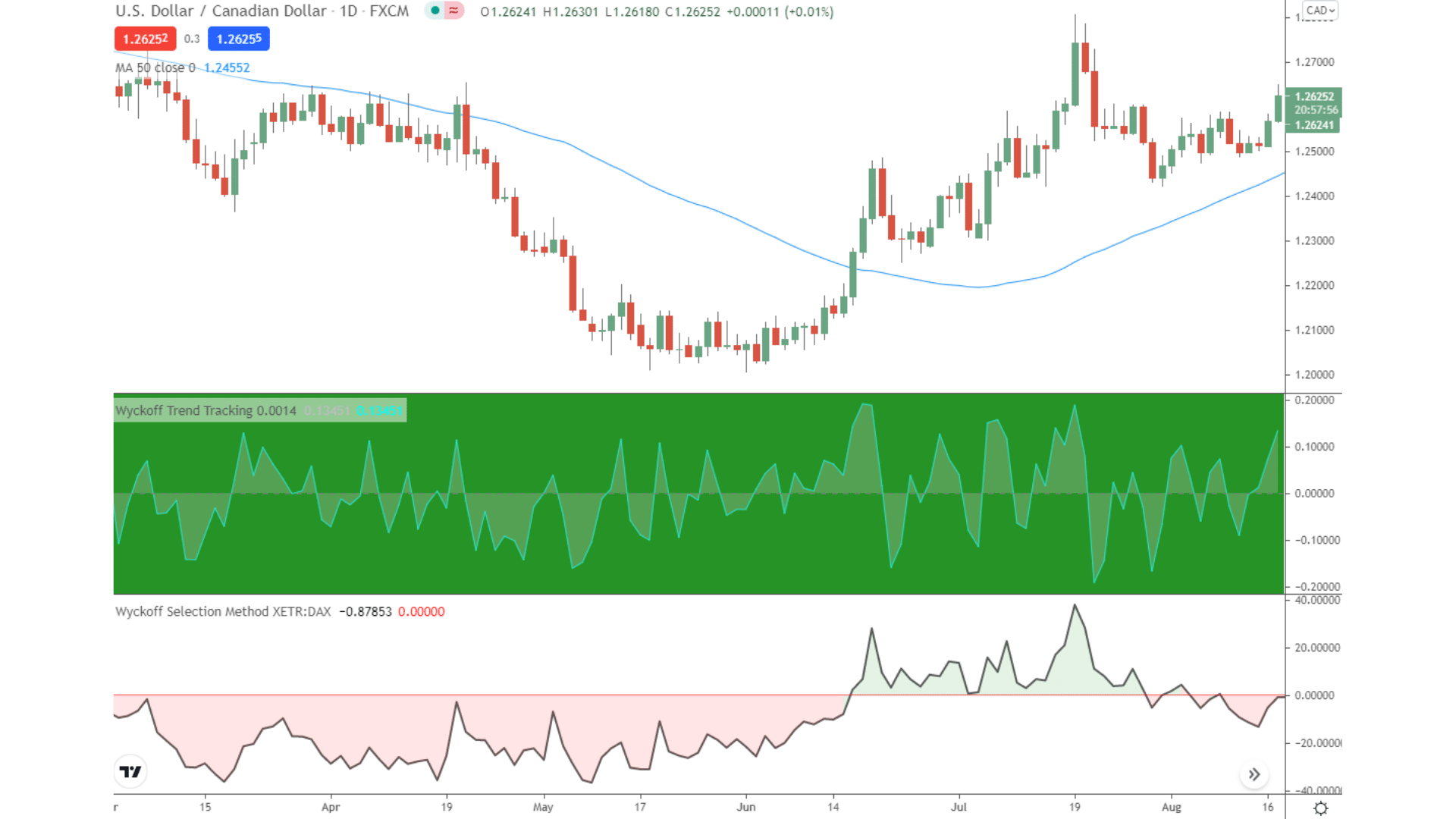

- Price Action and Volume: The Wyckoff Methodology emphasizes the importance of observing price action and volume to identify clues about the direction of the market.

- Charts and Diagrams: The Wyckoff methodology uses specific charts and diagrams to visualize the phases of accumulation and distribution, as well as patterns that signal reversals and breakouts.

The Importance of Reading “The Wyckoff Methodology in Depth: 2nd Edition”

Tom Williams’ second edition of “The Wyckoff Methodology In Depth” provides a deep dive into the intricacies of this powerful methodology. The book delves into the practical application of Wyckoff principles, taking readers beyond the theoretical framework and equipping them with the tools to effectively apply these principles to their trading. It presents detailed explanations of the Wyckoff charts, diagrams, and patterns, accompanied by real-life examples that illustrate the principles.

Image: zwemclubstz.be

Key Insights from the Book

Understanding Supply and Demand

The book emphasizes the importance of understanding the dynamic interplay of supply and demand in driving price action. It reveals how to identify the accumulation and distribution of stocks by analyzing the relationship between volume, price, and the activities of informed operators. The knowledge gained from understanding this dynamic can help traders identify key turning points in the market and capitalize on the expected price movements.

Reading the “Wyckoff Charts”

The Wyckoff Methodology uses specific charts and diagrams, known as “Wyckoff Charts,” to visualize the various phases of the market. The book provides a thorough guide to reading these charts, highlighting the key elements of each phase, such as the “upthrust,” the “backtest,” and the “spring,” which can act as powerful signals for market turns. By understanding these patterns, traders can anticipate the next market move and position themselves accordingly.

Developing a Trading Strategy

The book goes beyond simply identifying patterns and offers strategies for applying the Wyckoff Methodology in your trading. It guides you through the process of developing a robust trading plan based on the principles of accumulation, distribution, price action, and volume. The strategies presented focus on identifying entry and exit points, setting stop-loss levels, and managing risk, all based on the principles of the Wyckoff Methodology.

Case Studies and Examples

“The Wyckoff Methodology In Depth” is not just a theoretical treatise; it is packed with practical examples and real-world case studies that demonstrate the power of these principles in action. The book analyzes historical market movements, showcasing how the Wyckoff methods can be applied to identify key turning points and capitalize on price trends. These examples offer valuable insights and solidify your understanding of the methodology.

The Wyckoff Methodology In Depth 2nd Edition Pdf

Conclusion: Unlocking Your Trading Potential

The Wyckoff Methodology, as presented in “The Wyckoff Methodology In Depth: 2nd Edition,” provides a powerful framework for understanding market behavior and developing a profitable trading strategy. By understanding the psychology of market participants, the accumulation and distribution of stocks, and the patterns that reveal price movements, you can position yourself for success in the often-volatile world of trading. The book’s comprehensive approach, real-world examples, and practical strategies equip you with the knowledge and tools to navigate the markets with greater confidence and precision. Whether you are a novice trader or an experienced professional, investing in this book can be a valuable step toward unlocking your full trading potential.

We encourage you to explore further resources and delve deeper into the fascinating world of market psychology and price action analysis. Share your experiences, insights, and questions about the Wyckoff Methodology in the comments below. The journey of understanding the markets is a continuous one, and sharing knowledge is vital for success.